#CORL #Coruls #bestinvestment #DeFi #cryptoinvest #cryptotraders #staking

#CORL #Coruls #bestinvestment #DeFi #cryptoinvest #cryptotraders #staking

Maxone Club Plattform

Handel mit Maxone Club Plattform

Erleben Sie die beste Handelsplattform auf dem Markt. Integriert auf allen Geräten, vom Telefon bis zum Computer, um den Spielern das bestmögliche Spielerlebnis zu bieten.

Maxone Club - Handelsplattform für binäre Optionen von

Der Maxone Club ist eine renommierte internationale Online-Handelsplattform, die Privatanlegern und institutionellen Anlegern eine breite Palette von Handelsprodukten aus Devisen, Rohstoffen, Aktien, Indizes und Kryptowährungen bietet. Das Unternehmen ist weltweit erfolgreich und ein großartiger Ort, um seinen Kunden professionelle und zuverlässige Dienstleistungen zu bieten.

Das Ziel des Maxone Clubs ist es, mehr als 10.000.000 Menschen weltweit eine Plattform für Wechselkursprognosen mit einer professionellen, freundlichen, einfachen und sicheren Handelsumgebung zu bieten.

Unsere großartigen Funktionen

Unsere Kernleistungen

Wachstum und wem wir dienen.

Unsere Bewerbung

So erhalten Sie Ihre Karte

Nur 500 $ für Geschenkkarte! Verkauf von 50% Rabatt

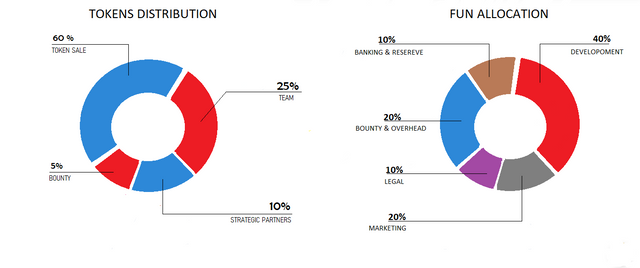

Token-Informationen

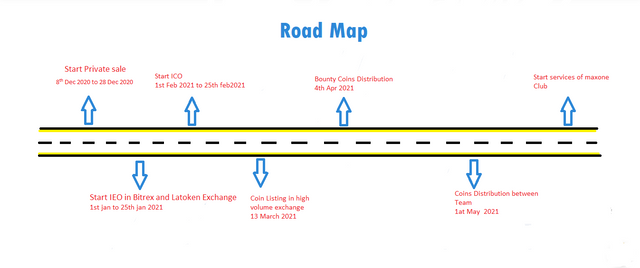

Roadmap

Fazit

MAXONE.CLUB wurde von einem Team von Finanzfachleuten gegründet, die über eine gesammelte Erfahrung von über 15 Jahren auf den globalen Forex-OTC-Märkten verfügen. MAXONE.CLUB ist eine einfache Alternative zum traditionellen Handel und möchte mit seiner benutzerfreundlichen Plattform Menschen zu Händlern machen. MAXONE.CLUB bietet bis zu 95% Auszahlungen, eine der höchsten Auszahlungen auf dem Markt für binäre Optionen.

https://binary.maxone.club/register ...

Um genauere Informationen zu erhalten, besuchen Sie bitte den folgenden Link:

AUTOR

BRIDGE

About

Bridge Mutual is a decentralized insurance provider that has embarked on its first ever offering of insurance coverage in one of the fastest growing digital asset markets: stablecoins. Bridge Mutual is based on a decentralized and discretionary insurance application that allows users to insure each other and get reimbursed in the event of a market crash or attack. Stablecoins are not always stable. They are also prone to damage and potentially useless. On October 15 2018, Tether, the stablecoin that dominates the market came under attack, broke the Tether peg to USD, dropping its value by 7%. When there is an attack, the market movements are very large and sudden. Assuming these attacks were legal and very profitable, like Soros' attacks, they would be repeated

Provide Coverage

Purchase Coverage

Private Sale Development

Q1 2021

Private Sale Development

Q2 2021

$100M Coverage Forecast Bridge DAO Governance

Q3 2021

Product Expansion Capital Pool Growth Coverage Growth

Q4 2021

Main net V2 Traditional Insurance

Team

For more information

Author

Bitcointalk Url: https://bitcointalk.org/index.php?action=profile;u=2852536

Clever is a DeFi protocol

It uses a Decentralized Distribution Mechanism (DDM) embedded within its smart contract that cannot be changed after it has been deployed. The DDM is what determines the value of CLVA and is responsible for distributing interest payments to all token holders of CLVA during the 888 cycle schedule.

What makes CLEVER DeFi unique is that it is truly decentralized and begins with zero initial supply, unlike other protocols that pre-mint tokens. Thus none of the development team owns any tokens and all tokens will be minted during the mint phase and accounted for on the blockchain.

This is important as it ensures minimal risk when investing or holding CLVA tokens since the team owns no initial supply and won’t be able to dump tokens in the market-leading to a price decrease. The CLEVER DEFI team only receives a fraction of tokens for each cycle (0.1%) for the development of the project.

PRESS RELEASE. Decentralized finance protocol CLEVER (CLVA) launches its latest program called “Will you take the 888 cycle challenge’’. The program offers a guaranteed interest model that enables users to earn compound interest paid fortnightly to all CLVA token holders.

This is achieved by placing all CLVA token holders on a pre-programmed routine cycle schedule over 888 fortnightly cycles that will take exactly 34.15 years to complete. Every 14 days newly minted CLVA is awarded to token holders. CLVA token holders will be able to receive up to 11% compound interest paid fortnightly within the cycles.

CLVA also offers impressive interest yield within the first year of minting. CLVA holders that hold their tokens for a year will be able to reap up to 307% interest on their portfolio at the end of the first year. This is more than what other DeFi yielding protocols offer to yield farmers and places CLEVER at the top of the list.

A unique aspect of the 888 cycle challenge is that CLVA tokens held are not entered into any term contract or staking period. Thus users have the freedom to move or send their CLVA tokens within cycles offering true decentralization within its ecosystem.

Also, there are no penalties for buying or selling CLVA within that period and the more CLVA held by investors the higher the interest earned.

You will receive your payments every fortnight without having to do anything. The process is fully automated.

Receiver Interest Every Fortnight

You will receive 11% compound interest just for storing your wealth. What’s amazing is that you won’t have to wait for years to receive that interest. You will get it every fortnight.

888 Fortnight Circles

Every 14 Days Like Regular Clockwork Distribution of Newly Minted CLVA is Awarded.

Verified and Audited

Smart Contract fully verified and CLEVER Protocol audited by BlockHunters. So, feel free to use CLEVER.

Safe and Secure

CLEVER is a DEFI protocol with an Automatic Cycle Schedule hardcoded into the Smart Contract itself.

ZERO Initial Supply

Every CLVA requires minting by a user and as such the CLEVER DEFI Team owns no supply

DAY 2-3

Mint Rate: 1 CLVA = 0.0021 ETH

DAY 4-7

Mint Rate: 1 CLVA = 0.0022 ETH

DAY 1

Mint Rate: 1 CLVA = 0.0020 ETH

DAY 8-10

Mint Rate: 1 CLVA = 0.0023 ETH

DAY 11-30

Mint Rate: 1 CLVA = 0.0024 ETH

INFORMATION

Website : https://clva.com/

Whitepaper : https://clva.com/Whitepaper.pdf

Facebook : https://www.facebook.com/cleverdefi

Telegram : https://t.me/cleverdefi

Twitter : https://twitter.com/cleverdefi

Youtube : https://www.youtube.com/c/CLEVERDEFI

LinkedIn : https://linkedin.com/company/cleverdefi

sVault.Finance

WHAT IS SCORE ?

sVault Finance is DeFi Stake and Yield Farming Platform. sCORE token is a decentralized staking platform that provides passive income to its investors by distributing rewards to users according to the amount of token staked and the retention time of the tokens on the staking platform. In addition, to yield farming strategies via smart contract sCORE provides security services for inexperienced users as a DeFi gateway and shows all on Blockchain to users for transparency purposes. sCORE can be easily integrated with DEX or other platforms for yield farming infra-structure and commission rebates. sCORE token can be used for staking, farming, fee rewards, voting and governance in the sVault Finance platforms.

Farming: 1% fee from each transaction is distributed amongst all holders. Percentage received by holders is directly proportional to the amount of token held in wallet at the time of reward.

Every holder automatically receives their own share of the fee. Payment is automated- No central party is assigned with distribution.

The revenues from stake, unstake and farming transactions are distributed to the stakers and a small part of them is burned. Thus, it aims to increase the passive income it provides to its investors by further reducing the supply.

SVAULT FINANCE

In the sCORE staking platform, the next node creator or block generator is chosen via a specific formula where the node creator must bet their sCORE token, so we use random to predict the submission. Create later using the formula to find the lowest hash value associated with the size of the stake.

So we try to achieve fairness instead of POW, where wealthy miners earn all the money. Since the stakes are public, each node can be predicted with reasonable precision that the next account will gain the right to forge the block.

The deposit reward will be provided by sVault dAPP instead of the user who is making the transaction. sVault uses Proof-of-Stake as a consensus mechanism. In Proof-of-Stake, to become a node validator, they need to stake their sCORE Token in order to be elected as the next node validator. Thus, sCORE Tokens will be given to the community of people who bet on their tokens.

The structured sVault Finance platform can be connected to a wallet, and investors can easily bet their tokens on the app. In the early phase of the project i.e. on the sVault Finance platform, investors can transfer their tokens to their wallet or another platform at any time without token locking time.

HOW IT WORKS

MINIMIZED RISK

Interest Account aims to give you high-yield returns as fast and as easy as possible. That’s why our new product is one of the most intuitive and accessible in our portfolio.

PASSIVE INCOME

You are guaranteed to earn a fixed interest on your asset. Watch your savings grow every day, withdraw whenever you want. Money works for you 24/7, even while you sleep.

WITHDRAW WHENEVER

Your funds are never locked as it often happens with a traditional bank savings account. You are free to withdraw the funds at any time with a single click.

HOLD SCORE

To generate profitability, HOLD or use the trade option within the exchanges where SCORE is available! Enjoy the DeFi technology to optimize your earnings.

SVAULT GOVERNANCE

In sVault Finance, the lending and borrowing will be supported only for specific assets and the sCORE token holders will be having the right to vote what other tokens are to be supported for lending and borrowing on sVault Finance. Each vote costs on sCORE Token.

LIQUIDITY INCENTIVE MINING

In sCORE, the users can provide liquidity to the stake and farming pool. Users shouldn’t lock sCORE in the pool. The user provide liquidity will be receiving liquidity incentive mining rewards.

These rewards are provided in the form of sCORE Tokens.

THE DETAILS PRIVATE SALE AND PUBLIC SALE ARE AS FOLLOWS:

Join our whitelist to get sCORE tokens. The sVault Token Sale team is our platform’s first client. We are running a referral program on the sVault decentralized platform for our Private Sale and Pre Sale. Simply refer a friend and receive sCORE tokens.

TOKENOMICS

DISTRIBUTION

Today many DeFi platforms operate in the crypto market and offer innovative and profitable services to global crypto users. And sVault Finance is part of that potential DeFi sector. sVault Finance allows users to stake, swap, and farm, which maximizes their profit. With sVault Finance, users can get passive income even when they sleep. It's time to enjoy the limitless power of compound interest and let the system do the work for you.

More Information

Website: https://svault.finance/

Twitter: https://twitter.com/sVaultFinance

Telegram: https://t.me/sVault_Finance

Linkedin: https://www.linkedin.com/company/svaultfinance

Facebook: https://www.facebook.com/sVaultFinance

Github: https://github.com/sVault-Finance

AUTHOR

Bitcointalk Username: Karim Benzema

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=2852536

Telegram Username: @KarimBenzema4